Cash is King

Many businesses face liquidity crises; the list is growing fast and becoming endless. What causes this brutal phenomenon? There are no easy answers. Here we aim to introduce an approach by which leaders can minimize liquidity management risk and enrich the experience of key stakeholders. A sophisticated approach in governing order-to-cash (OTC) process is an essential prerequisite for achieving and sustaining success.

Order-to-cash process is an important part of organizational phenomena. It is a defining part of a company’s success and the major pillar of working capital management. Furthermore, the OTC process also plays a big role in driving an organization’s relationship with customers. The end-to-end OTC process includes quoting, contracting, invoicing, collecting, crediting, ordering and renewing. Therefore, managing the complexity of order-to-cash process requires coordination and alignment across multiple functions: 1) sales 2) pricing 3) finance 3) legal 4) operations and 5) customer services.

There are many theorists and practitioners who promise tangible and sustainable results in improving the OTC process by applying contemporary models, tools and techniques. We claim it is necessary to think differently, in terms of rational systems but irrational people within those systems. We need to remove biases from our thinking and decision-making.

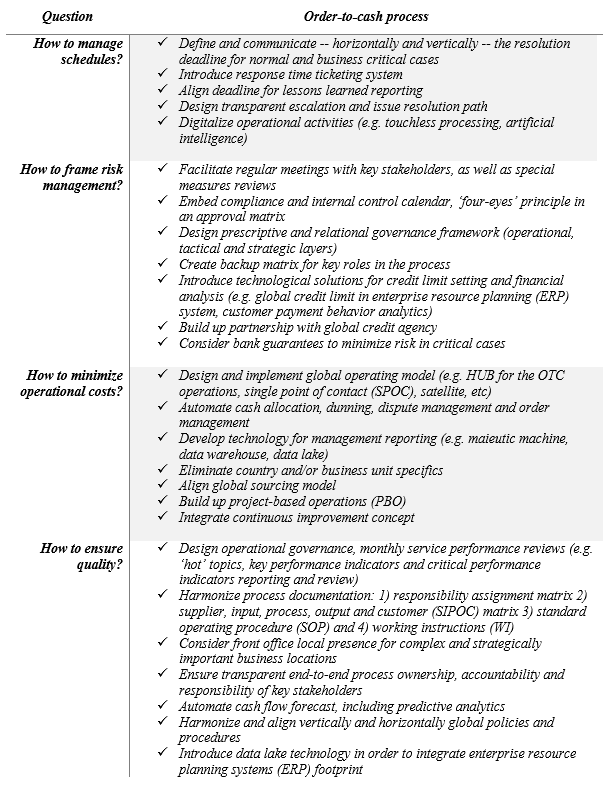

Here we propose a simple technique – a set of ‘how’ questions -- leaders should ask themselves when properly designing operational environments. This is a set of lenses exploring the ‘latitude and longitude’ of order-to-cash processes. Though there is no best paradigm for organizing these processes, businesses must answer the essential ‘how’ questions: 1) How to manage schedules? 2) How to frame risk management? 3) How to minimize operational costs? 4) How to ensure quality?

Answering these questions first helps to deliver success in terms of quality, efficiency, and effectiveness of the process. Second, it helps to enhance order-to-cash operations and, therefore, helps to satisfy customers. Third, it helps to design, develop and effectively lead order-to-cash processes. These questions give leaders a compass to steer the process rightly. Indeed, addressing these questions establishes transparency when formulating the OTC strategic response to critical market complexities and business uncertainties.

Answering these questions governs the OTC process and yields remarkable benefits that ripple through a business. In Table 1 below we summarize the range of answers for the above fundamental questions. The proposed range of answers is a practical repertoire based upon empirical results. Importantly, it is not an exhaustive list by any means.

Table 1 The ‘how’ questions in order-to-cash process

Finding the answers to these questions helps to develop and employ a more holistic order-to-cash operating environment. On the one hand, it gives leaders a framework for wisely combining digital technologies and operations capabilities. On the other hand, it organizes key stakeholders around the process in an integrated, well-sequenced and connected way. For these reasons, it streamlines responsibility as well as accountability. As a result of those changes, companies increase revenues, reduce costs and improve the customer experience. Overall, those major improvements can yield considerable value and deliver long-term benefits to a broader stakeholder’s community.