Righting the Global Operating Ship

“Sensing a delicate change in the seasons

you savor the world, and you are opened.”

- William Ayot

Global businesses have an enormous impact on nations and communities across the world. Business leaders are creating social value by expanding globally and partnering with cross-border institutions. The international market opportunities bring distinctive strategic value and winning margins of global projects through 1) labour arbitrage 2) currency and compliance risk hedging 3) access to unique resources and services, including manpower and ‘know-how’. However, various problems remain in both the practical and theoretical sides of global ecosystems.

In this article we describe two main aspects of improving the global operating model: 1) the in-house vs out-source (BPO - business process outsourcing) decision-making matrix and, building on that 2) the country complexity tool - to explore and right the global operating ship. Both aspects are organically linked and feed each other correlated data. Further, the in-house vs out-source matrix aids the global decision-making process. The country complexity tool frames necessary information and connections that are available, correct and unbiased.

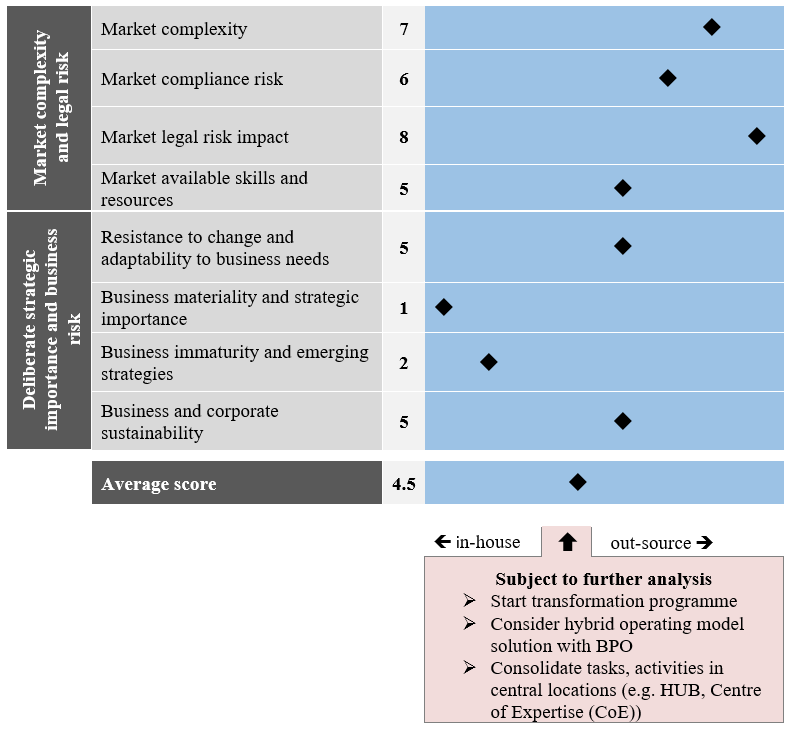

Figure 1 illustrates the in-house vs out-source operating model decision making matrix. It employs a set of lenses: 1) Market complexity and legal risk 2) Deliberate strategic importance and business risk. These lenses help leaders analyse data and design target operating models.

Figure 1

The in-house vs out-source (BPO - business process outsourcing) decision-making matrix

The in-house vs out-source decision-making matrix analyzes 1) Market complexity and legal risk categories: market complexity, market compliance risk, market legal risk impact, market available skills and resources, and 2) Deliberate strategic importance and business risk categories: resistance to change and adaptability to business needs, business materiality and strategic importance, business immaturity and emerging strategies, business and corporate sustainability. The range of possible scores is organized from a low of 1 to a high of 10, evaluating 1) Market complexity and legal risk and 2) Deliberate strategic importance and business risk categories.

For instance, if the market compliance risk is (8), it means: a) the compliance environment, including tax and statutory regulations, is complex, b) there are controversial requirements for reporting and c) tax regulations are subject to frequent changes and are unsustainable. Further, if the resistance to change and adaptation to business needs is low, a score of (1) indicates that the business unit is flexible and adaptable to changing internal and external regulations, requirements and policies. In the table below we illustrate the sourcing direction, which is based on the average score obtained after applying the in-house vs out-source decision-making matrix. Overall, the average score gives an unbiased account of the deliberate sourcing strategy.

Table 1 The average score and deliberate sourcing strategy

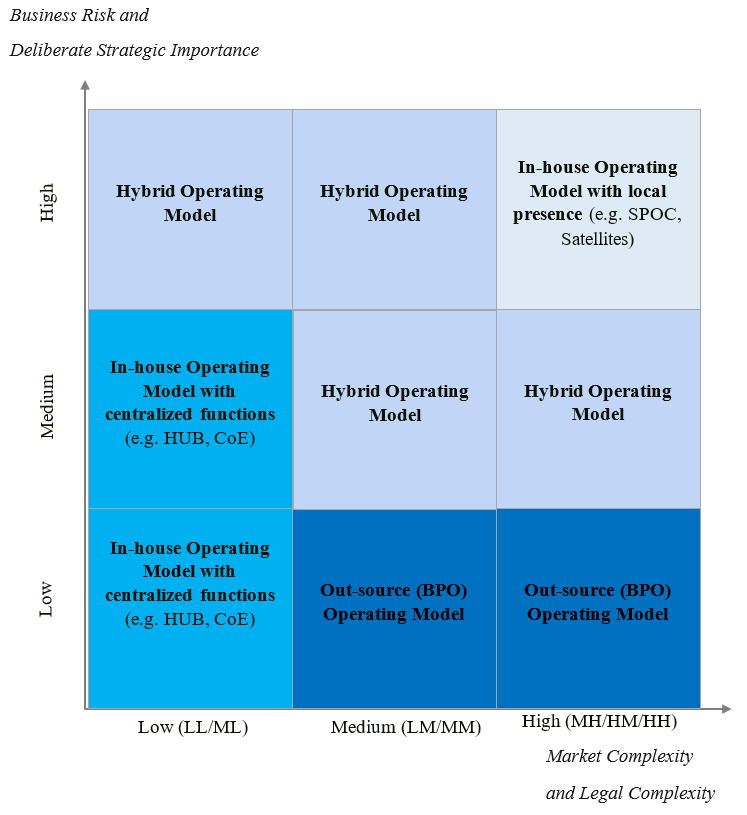

Our next step is to closely analyse the global capacity and operating model. To do so, we can employ the country complexity technique, a matrix with two dimensions: 1) Business Risk and Deliberate Strategic Importance, 2) Market Complexity and Legal Complexity.

Figure 2 shows the country complexity tool, which can be used to define a target operating model in a global business environment:

In-house operating model with local presence

In-house operating model with centralized functions

Out-source (BPO) operating model

Hybrid operating model, a fusion of internal (local and/or central) and external capacity

Figure 2 The country complexity tool

On the vertical axis, Business Risk and Deliberate Strategic Importance is organized from ‘Low’ (low business risk and strategic importance) to ‘High’ (high business risk and strategic importance).

On the horizontal axis, Market Complexity and Legal Complexity is designed accordingly:

Low (LL) indicates low market complexity and low legal complexity; ML indicates medium market complexity and low legal complexity

Medium (LM): low market complexity and medium legal complexity; MM: medium market complexity and medium legal complexity

High (MH): medium market complexity and high legal complexity; HM: high market complexity and medium legal complexity; HH: high market complexity and high legal complexity

Large assumptions need to be tested for validity, uncertainty and level of influence, in order to ascertain the complications inherent in the chosen operating model. For an even more unbiased analysis, corresponding thresholds, calculated with a formula, should be embedded. As Kahneman (2012) observed, “…to maximize the predictive accuracy, final decisions should be left to formulas, especially in low-validity environments”. Indeed, the tool helps find the ways to minimize the risk with unrealistic best-case scenarios and minimize planning fallacy risk.

For instance, if Business Risk and Deliberate Strategic Importance is ‘Low’ and Market Complexity and Legal Complexity ‘High’ and/or ‘Medium’, the BPO Operating Model is preferred. Further, if Business Risk and Deliberate Strategic Importance and Market Complexity and Legal Complexity are both ‘Low’, the In-house Operating Model with centralized functions is recommended. On the other hand, if Business Risk and Deliberate Strategic Importance is ‘High’ and Market Complexity and Legal Complexity ‘High’ and/or ‘Medium’, the In-house Operating Model with local presence is a rational approach to take. Furthermore, the Hybrid Operating Model is useful for cases with ‘High’ and/or ‘Medium’ Business Risk and Deliberate Strategic Importance and ‘Medium’ Market Complexity and Legal Complexity. Importantly, partnering with a global business process outsourcing provider minimizes the risks associated with hybrid solutions for operating models. Indeed, a partnering engagement responds strategically to ‘High’ Market Complexity and ‘Medium’/‘High’ Legal Complexity cases. Moreover, hybrid solutions create participatory governance with key stakeholders and enable contractual partners to work together in a spirit of partnership, openness and trust for their mutual benefit. (see Risk Management in Business Partnering Engagements).

In conclusion, the holistic approach is crucial when designing the global operating model. The in-house vs out-source decision-making matrix and the country complexity tool help leaders to find solutions. As a result, considerable value will be created and long-term benefits delivered. This approach will allow what Taleb (2010) observed: “…to specialize in the creative aspect of things, the production of concepts and ideas, that is, the scalable part of the products, and, increasingly, by exporting jobs, separate the less scalable components and assign them to those happy to be paid by the hour.’’ (p. 31).

References

Kahneman, D. (2012) Thinking, Fast and Slow (Great Britain: Penguin Books).

Taleb N. The Black Swan: The Impact of the Highly Improbable, 2nd ed., (New York: Random House, 2010).