Planning and Forecasting

Reliance on planning and forecasting has mushroomed since the dawn of the computer era. Data flows freely up and down the business hierarchy, greatly enhancing leaders’ ability to oversee performance and respond in real time. Nonetheless, there are still substantial problems in both theoretical and practical development of planning and forecasting; examining these problems carefully will inform future research. For example, what are the root causes of errors in business estimations and cost-benefit analysis? How can business leaders be guided to use the information available to them? Can statistical principles and methods account for the irrationality of the human mind?

Management research often focuses on the immediate causes of poor management estimates rather than on the root causes of those. Our experience and the available empirical evidence lead us to reframe the forecasting problem: leaders need to think about rational systems but also the irrational people within those systems. Some perspectives may seem clear, while others remain puzzling. More than 400 years ago, Galileo learned this when he devised the first telescope and discovered that each additional lens produced a more accurate image of the heavens. Business leaders can take advantage of the same truth, using multiple lenses to diagnose what they are up against and how to move forward.

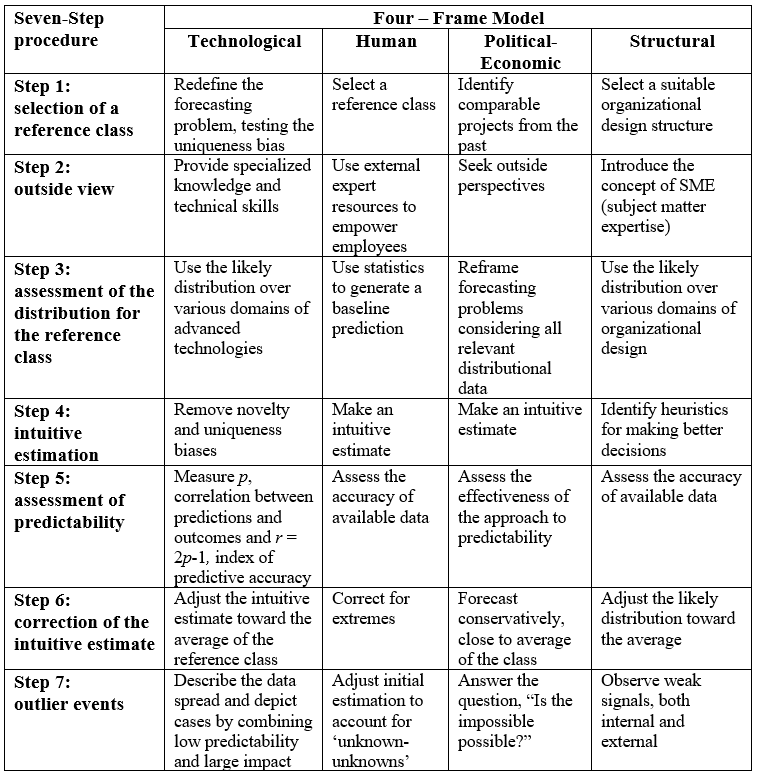

Our idea is to apply the ‘Four-Frame’ model with the ‘Seven-Step’ corrective procedure. The model uses a proper set of lenses for making business estimations and charting future directions. This model considers four fundamental frames in predictions: 1) Technological 2) Human 3) Political-Economic and 4) Structural. Leaders can apply the model to remove forecasting bias and develop strategic responses to uncertainty. Each of the frames adds its own depth to management estimations and its own range of responses to business uncertainty. In the following table is an overview of the ‘Four-Frame’ model with the ‘Seven-Step’ corrective procedure.

Table 1

The ‘Four-Frame’ model with the ‘Seven-Step’ corrective procedure (inspired by Kahneman and Tversky (1979)

Our initial questions were these: “What are the root causes of errors in business estimations and cost-benefit analysis? How can business leaders be guided to use the information available to them? Can statistical principles and methods account for the irrationality of the human mind?”

The main empirical observations concern the ways in which Flyvbjerg et al. (2018) define human bias, both psychological and political. The root causes of errors in business estimations and cost-benefit analysis are overconfidence bias, planning fallacies and strategic misrepresentation. Furthermore, the root causes appear to be true from a behavioural science perspective as well: it is not hidden weaknesses in forecasting models and statistical methods, scope changes, complexity, business cycles, or the like. Rather, bias is the biggest risk in management estimations. Statistical principles and methods are too rational to predict the irrationality of the human mind. Accordingly, in order to prevent cost overruns, schedule delays and benefit shortfalls, leaders should strive to remove bias from their predictions. Applying the ‘Four-Frame’ model with the ‘Seven-Step’ corrective procedure will help leaders do exactly this.

References

Flyvbjerg B., Ansar, A., Budzier, A., Buhl, S., Cantarelli, C., Garbuio, M., Glenting, C., Skamris Holm, M., Lovallo, D., Lunn, D., Molin, E., Rønnest, A., Stewart, A. and van Wee, B. (2018) “Five Things You Should Know about Cost Overrun”, Transport Research Part A: Policy and Practice, 118: pp. 174-190.

Kahneman D., Tversky, A. (1979). Intuitive prediction: Biases and corrective procedures. In Makridakis, S., Wheelwright, S.C., eds., Studies in the management sciences: Forecasting, vol. 12. Amsterdam: North Holland, pp. 313–327.