In a business environment defined by speed, ambiguity, and constant change, organizations need operating models that translate strategy into everyday action.

The Non‑Negotiable: A True Sense of Urgency

Urgency is the catalytic energy that turns intention into motion; it is the difference between a program people attend and a movement people own.

Statement of Intent: "Cracking the Code of Transformation Programme"

"Cracking the Code of Transformation Programme" will be a practical, insightful, and inspiring resource for professionals dedicated to making transformation a reality.

Accelerating Value Creation: How AI is Transforming Tax, Accounting, and Finance

The rapid development of AI is rewriting the story of tax, accounting, and finance. By automating routine tasks, enhancing analysis, and supporting strategic decision-making, AI is unlocking new levels of efficiency, quality, and value.

What Leaders Can Learn from The Book of Joy

In the end, the leader knew that joy was not just a personal pursuit, but a collective journey. By leading with joy, they had helped others find their own light, even in the darkest of times. And in doing so, they had discovered the true power of leadership—not to control or command, but to inspire, connect, and uplift.

Sport as a Natural Human Development Enabler

Through the journey of my daughter and the many athletes I’ve observed, it is clear that sport is one of the most powerful tools we have for human development. Especially in its team-based forms, it teaches us how to strive for excellence, how to connect with others, and how to face life’s challenges with strength and grace.

Continuous Change: The Strategic Advantage in a Rapidly Evolving World

Continuous change is not a strategy—it is a mindset. It is a way of being that aligns with the rhythms of nature and the realities of business. It requires courage, curiosity, and compassion. It requires seeing beyond the present, connecting across boundaries, and evolving not for survival alone, but for the common good.

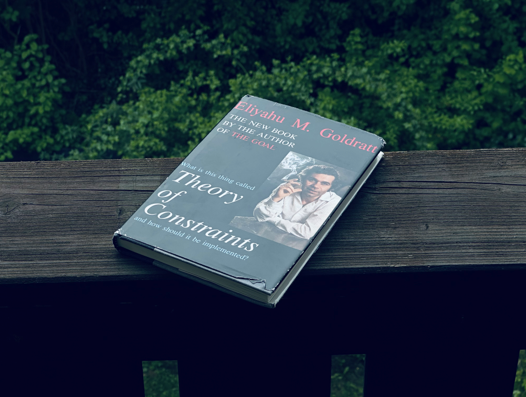

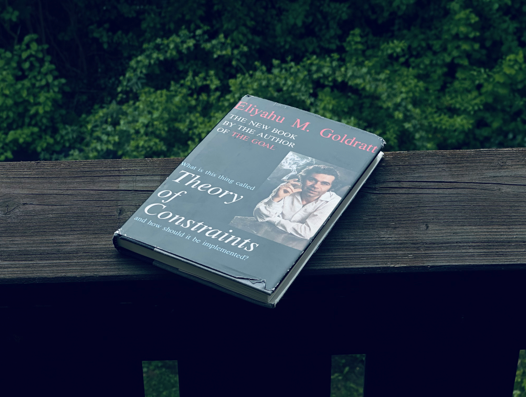

Cracking the Code of GBS Evolution with the Theory of Constraints

The evolution of Global Business Services (GBS) is a journey shaped by strategic ambition, operational pressures, and technological transformation. As organizations increasingly rely on GBS to streamline operations, deliver efficiency, and enable enterprise agility, a pressing question arises: what limits GBS from evolving into a truly strategic powerhouse? The Theory of Constraints (TOC), introduced by Eliyahu Goldratt, offers a compelling narrative and practical lens to explore this question.

Decisive: Changing the Way We Make Choices

Decisive offers a powerful reminder that our choices shape our lives, and that we’re not at the mercy of our mental flaws. With the right approach, we can become better decision-makers.

Mature Global Business Services Organization – What’s Next?

Maturity is not the end of the journey—it’s the beginning of reinvention. For GBS organizations that have mastered operational excellence, the next horizon is strategic enablement.

Applying Goldratt’s Theory of Constraints in a Consulting Company

The Theory of Constraints provides a compelling framework for consulting firms seeking to improve delivery, scale operations, or simply gain clarity on what’s holding them back.

Refining Tax Function Operating Model

Incorporating design thinking into the development of a tax function operating model represents a transformative approach to modernizing tax processes.

Applying Marcus Aurelius' 'Meditations' to Leadership

Marcus Aurelius’ “Meditations” offers timeless wisdom that can significantly enhance modern leadership.

Enhancing Tax Compliance with AI Technologies

This article explores how the AI technologies are utilized to automate and improve the efficiency of tax processes, providing a comprehensive solution for organizations aiming to streamline their tax operations.

Establishing Centers of Expertise: Strategic Value in Efficiency, Innovation, and Digitalization

One effective strategy that has gained significant traction is the establishment of Centers of Expertise (CoE). These centralized hubs of specialized knowledge and skills create substantial strategic value, driving efficiency, innovation, and the digital transformation of business processes.

The 24-Hour Countdown: A Method for Enhanced Productivity and Well-Being

This article provides a comprehensive overview of the 24-hour countdown technique, highlighting its methodology, benefits, and applications. By implementing this technique, individuals can gain valuable insights into their daily routines and make informed decisions to enhance their productivity and overall quality of life.

The Change Enables Stability

The relationship between change and stability is a complex but essential aspect of successful transformation programs.

Reporting Methodology: Asking The Right Questions

Despite the abundance of data, many business leaders struggle to achieve the desired outcomes in terms of cost, time, benefits, quality, and risk management.

"Be Useful: Seven Tools for Life" – Seven Tools of Transformational Leadership

This book is not just a memoir but a guide to transformational leadership, offering seven essential tools that can drive significant change in both personal and professional realms.

Strategic Reframing in Tax Function Processes and Operating Models

In the contemporary business environment, characterized by turbulence, uncertainty, novelty, and ambiguity (TUNA), traditional tax function processes and operating models are increasingly inadequate.